What are NAICS codes and how can they be for retail market analysis?

North American Industry Classification System codes (NAICS), are useful for several reasons.

They provide a standardized way of classifying businesses and industries in North America. This allows for easier comparison and analysis of economic data across different regions, industries, and time periods.

NAICS codes are used by government agencies, such as the Census Bureau and the Bureau of Labor Statistics, to collect and analyze data on businesses and industries. This data is then used to inform policy decisions and to track economic trends. Businesses can to identify potential customers or suppliers, as well as to benchmark their own performance against industry averages.

NAICS codes can be used to identify the specific type of retail industry being analyzed. By examining the sales data of businesses with a particular NAICS code, it is possible to determine the size and growth rate of that industry, as well as its market share within the larger retail sector. For example, a market analyst interested in the home improvement retail market could use NAICS code 444 to identify businesses primarily engaged in this industry and then analyze their sales data to determine market trends.

They can also be used to segment the retail market based on different product categories or consumer demographics. This allows analysts to better understand the competitive landscape for different product categories within the retail market. It also allows retailers to understand the market saturation and competitive analysis for

NAICS codes can be used to compare retail market data across different geographic regions.

For example, by examining the sales data for a particular NAICS code such as “Grocer stores” for different regions, analysts can determine how retail market trends vary across different locations and analyze sales data to determine which areas have the highest concentration of grocery stores.

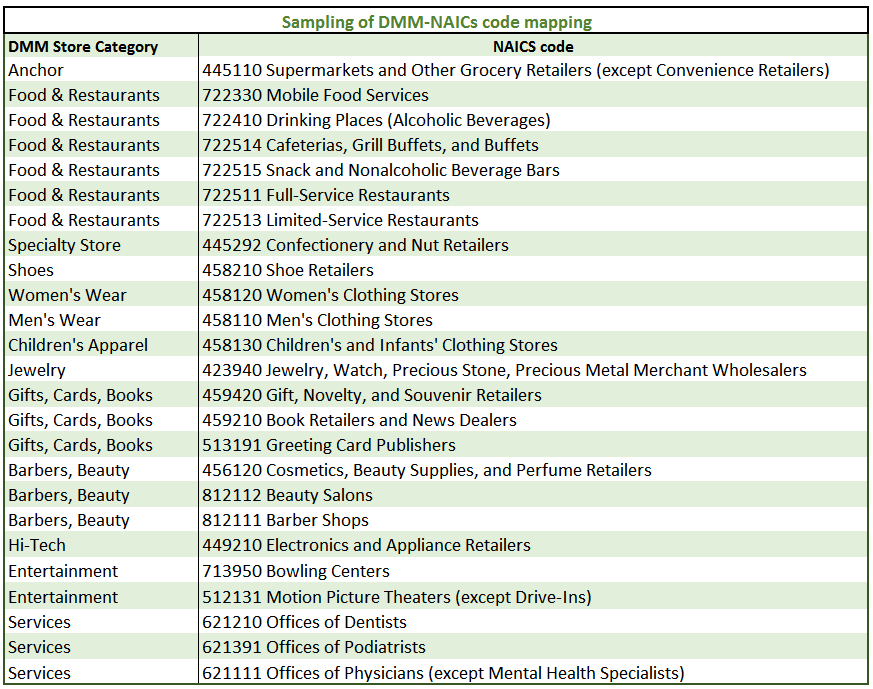

Why it is important that NAICs codes and Retail Chain Store types have been applied to the tenants listed in DMM’s shopping center dataset?

DMM’s integration of NAICS codes & Retail Store Chain Types is a critical growth step and opportunity for Direct Licensees and Resellers to append larger datasets that are driven by retail category classifications. It ensures that statistical reporting and analyses are uniform across geographies when utilizing additional analytic components.

NAICs codes can help retailers analyze retail market saturation and uncover growth opportunities

As an example, DMM’s comprehensive retail dataset can be tailored to:

- Provide detailed NAICS Saturations across Shopping Center Classifications.

• Analyzing areas of investment based on industry/retail types present. - Assess larger US Census Data, both Raw & aggregated by 3rd parties

• Retail Sales by Category or targeted codes.

• Transactional behaviors by NAICS type.

• Historical trends - Identify Other Government Opportunities across multiple areas.

• Funding source opportunities by category or specific NAICS.

• Industry type growth opportunities within a market. - Direct audience outreach through Digital Media

Overall, NAICS codes provide a useful tool for analyzing retail market information at both a high level (i.e. total retail sales in a given industry) and a more granular level (i.e. sales trends for specific types of products or in specific geographic regions). The enrichment of the DMM tenant data with these codes further enhances the power of retail market analysis with DMM custom data.

Contact a DMM expert to discuss the various options available for licensing the DMM data and integrating it into your site selection, market analysis and retail intelligence platforms and processes.

Related articles and links:

- NAICs codes in DMM custom data

- How are Chain Stores Classified?

- Retail Chain Type classificationuseful for analytics

Tama J Shor President, Directory of Major Malls / ShoppingCenters.com

Tama J Shor President, Directory of Major Malls / ShoppingCenters.com

Tama has over 35+ years of experience of researching, maintaining and analyzing major retail information and trends in the shopping center industry. Under her leadership, DMM’s portfolio of offerings has expanded from the original print products to include robust on-line subscription access, custom reporting, data licensing, and integration with mobile data, segmentation and geospatial analysis. Tama’s deep knowledge and industry insight has driven DMM to become a premier source for comprehensive retail data for retail, finance, media, academic and government analysis of the retail shopping center industry.Retail